Kentucky and bourbon are virtually synonymous. The amber nectar of the gods owes it’s storied history to early Kentucky settlers eager to use ample supplies of corn and cooked with the mineral-rich water flowing through the limestone bedrock of the state.

Kentucky and bourbon are virtually synonymous. The amber nectar of the gods owes it’s storied history to early Kentucky settlers eager to use ample supplies of corn and cooked with the mineral-rich water flowing through the limestone bedrock of the state.

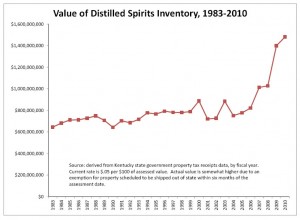

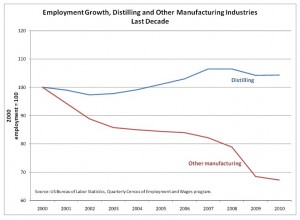

A new bourbon economic impact report released Thursday proudly outlines the significant impact the bourbon industry has in Kentucky. Lately it’s been reported that bourbon is on a growth spurt not seen since the early 1980s.There is job growth in an otherwise weak economy. Exports are thriving and tax revenue continues to fund school systems, local and state governments.

So what’s the issue? Maybe Kentucky could be capturing even more from the bourbon industry if certain taxes were not the highest anywhere, and that revenue reinvested in the distilling industry.

So what’s the issue? Maybe Kentucky could be capturing even more from the bourbon industry if certain taxes were not the highest anywhere, and that revenue reinvested in the distilling industry.

Aging bourbon in barrels is taxed like cars in Kentucky. Anyone in Kentucky who registers their vehicle each year knows they are required to pay a property tax on their vehicle in addition to the cost of the tags.

Kentucky distillers face the same tax. They are paying a property tax on every barrel of aging bourbon stacked in warehouses around the state. According to the economic report, there are nearly five million barrels aging around the state.

That’s a lot of Mint Juleps – if you believe in mixing good bourbon with simple syrup and mint.

That bourbon has little value until it is bottled and sold. You could argue that each year the bourbon ages it gets better and increases in value. But, think of it this way – you buy a new car then park it in your garage and never drive it. You will continue to pay taxes on that car year after year. That car you are not driving has little value until you sell it.

Alcohol has a long history as a gravy train for government. Prior to prohibition taxes on alcohol generated about a third of federal revenue. That was before the income tax. During prohibition all that revenue dried up while illegal alcohol consumption continued. Finally, the struggling federal government decided that maybe prohibition shuould end during the Great Depression as a way to again capture that tax revenue.

The property tax is one of seven taxes on every bottle of bourbon in Kentucky. When you fork over $20 or so for a bottle of Maker’s Mark or Eagle Rare about 60 percent is for taxes in some way.

Tennessee taxes spirits at two-thirds the rate in Kentucky. Elsewhere, domestic wine-producing leader California has one of the lowest wine excise taxes. And the top beer states of Missouri, Colorado and Wisconsin, have similarly low rates on that product.

Maybe there is a way to create incentives to encourage industry reinvestment in the state.

There are good bourbons being produced outside Kentucky. Right next door in West Virginia there is Smooth Ambler.

At this point, bourbons created outside Kentucky are mostly “craft” products, but the same dynamics that sent manufacturing elsewhere could damage Kentucky’s bourbon industry. Never say never.

If nothing else, some of those 5 million barrels aging warehouses could be stacked somewhere like Madison, Ind. There is little difference in climate conditions. The result would be no property tax revenue for schools and other government operations.